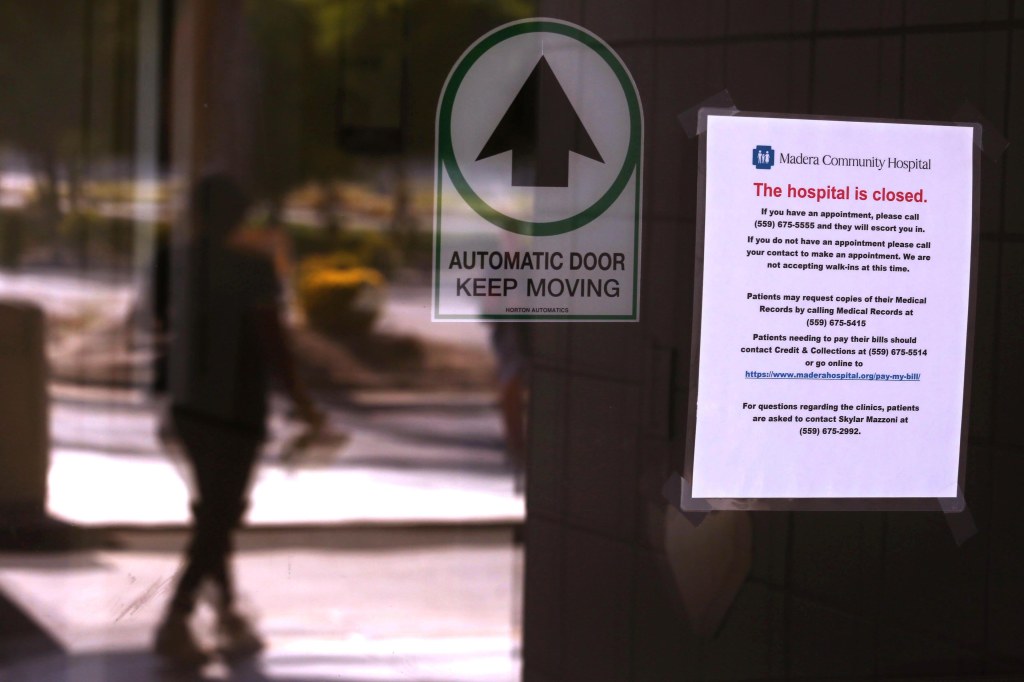

Madera Community Hospital in California’s Central Valley, which ceased operations last December and filed for Chapter 11 bankruptcy in March, moved a step closer to reopening Thursday when California’s new fund for troubled hospitals said it was prepared to offer the facility up to $52 million in interest-free loans.

The program is offering an additional $240.5 million in no-interest loans to 16 other troubled hospitals, including Beverly Community Hospital in Montebello and Hazel Hawkins Memorial Hospital in Hollister, both of which filed for bankruptcy earlier this year.

Hazel Hawkins will get a loan of $10 million, and Beverly will get a bridge loan of $5 million while it is being purchased out of bankruptcy by Adventist Health’s White Memorial in Los Angeles, according to the state’s Department of Health Care Access and Information, which unveiled the lending details Thursday.

Adventist Health has also agreed conditionally to manage Madera if it reopens. If all goes well it would take six to nine months to reopen, officials said.

Madera will get a bridge loan of $2 million to cover basic costs while Adventist Health, a large multistate health system with 22 hospitals in California, works on a “comprehensive hospital turnaround plan,” the department said. Once such a plan is approved, Madera “can be eligible for an additional $50 million loan” from the distressed hospital program, it said.

For most of last year, Fresno-based St. Agnes Medical Center, part of the large Catholic hospital chain Trinity Health, appeared poised to rescue Madera Community Hospital from financial ruin in a planned acquisition that was approved by California Attorney General Rob Bonta. But Trinity walked away from the deal at the last minute with scant explanation, infuriating Bonta along with multiple other political leaders, community advocates, and health care officials.

Trinity, which had loaned Madera $15.4 million during their merger talks, became its largest creditor in the bankruptcy that ensued. At the time of its bankruptcy filing in March, Madera reported total debts of just over $30 million.

Adventist Health agreed last month to a nonbinding letter of intent to manage Madera. At the time, Kerry Heinrich, Adventist’s president and CEO, said that if the shuttered hospital got the requisite financing, Adventist Health would use its expertise in “helping to secure a sustainable future for healthcare” in the county.

Adventist Health spokesperson Japhet De Oliveira said Thursday that his organization remains intent on doing so. Reopening Madera “would be a really good thing, and we will put every effort into making that happen,” De Oliveira said. He added: “We will need all parties to be involved in developing the approved plan and negotiating the terms of management services.”

Karen Paolinelli, the CEO of Madera Community Hospital, did not respond to emailed questions by publication time.

State political leaders representing the region expressed satisfaction with Thursday’s news. “It brings me tremendous relief to know that Madera Community Hospital and Hazel Hawkins Memorial Hospital in San Benito County have received grant awards and will be able to ensure that community members can once again receive services in their own communities,” said Sen. Anna Caballero, a Democrat who represents the areas in which those facilities are located.

The Adventist letter of intent for Madera said that in addition to paying off creditors in the bankruptcy, the hospital would need to secure $55 million in the first year to pay for all aspects of reopening, plus an additional $30 million in the second year.

The $52 million the state proposes lending to Madera is significantly short of the $80 million the hospital applied for. Assuming the full $52 million materializes, the total amount loaned to the 17 hospitals would be $292.5 million — nearly the entire $300 million available to the fund for fiscal years 2023 and 2024. The program is scheduled to end after 2031.

With $52 million from the state, Madera Community Hospital would still need to find an additional $33 million. Madera said in a bankruptcy court filing earlier this year that it expects just over $33 million in revenues from “provider fees” and from the Federal Emergency Management Agency.

The law that created the distressed hospital loan fund, AB 112, initially provided for $150 million in lending to help troubled hospitals, mostly rural ones, that faced the risk of closing. Another $150 million was later added to the pot. Small hospitals across the state — and the country — have been buffeted by the ill economic winds of the covid-19 pandemic, which ratcheted up the cost of drugs, supplies, and labor.

Hospital industry officials have also pointed to low payment rates by government programs, especially Medi-Cal, California’s Medicaid program, which they say has saddled many hospitals with financial losses.

Madera made the same argument, but state data shows it received enough supplemental payments to earn nearly $15 million from Medi-Cal in 2021, though it lost over $11 million treating Medicare patients.

The hospitals awarded the largest loans by the distressed hospital fund are Tri-City Medical Center in Oceanside, with $33.2 million; Dameron Hospital Association in Stockton, with $29 million; Pioneers Memorial Healthcare District in Imperial County, with $28 million; and El Centro Regional Medical Center, with $28 million.