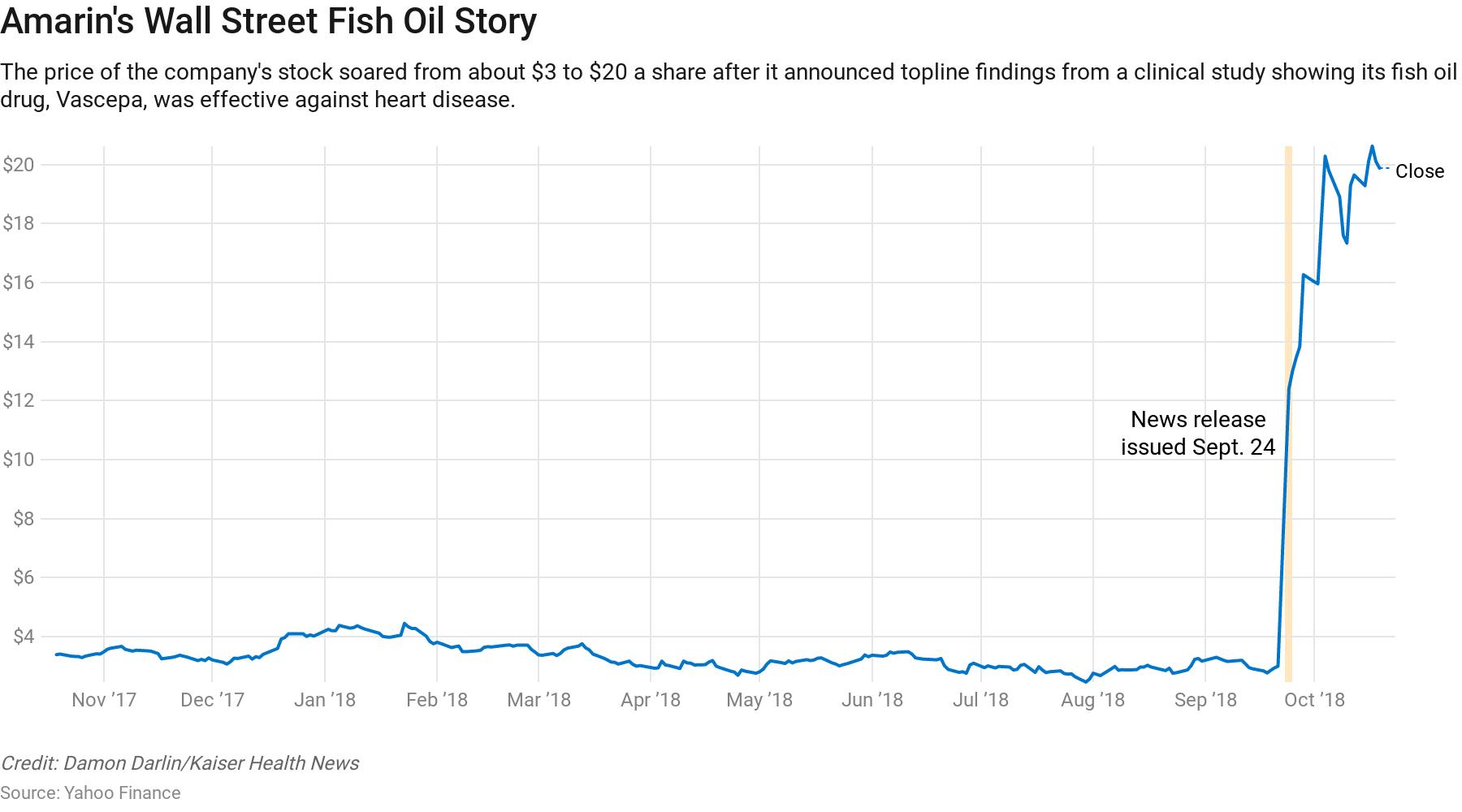

At the end of September, Amarin Corp. teased some early findings for Vascepa, its preventive medicine for people at risk of heart disease. The claim was astounding: a 25 percent relative risk reduction for deaths related to heart attacks, strokes and other conditions. Headlines proclaimed a potential game changer in treating cardiovascular disease. And company shares quickly soared, from $3 a share to about $20.

Vascepa is Amarin’s only product. The company wants to turn its pill made of purified fish oil into a cash cow, allowing it to staff up both in the United States and abroad so it can sell doctors and millions of consumers on its medical benefits. Although the product has been on the market for more than five years, its first TV ad campaign rolled out this summer in anticipation of the study findings.

Except there is one problem. The particulars of the scientific study on which this claim was based remain a mystery.

Amarin’s preliminary announcement came via a news release on Sept. 24. The company plans to release detailed findings in November at the national American Heart Association conference. Then early next year, it plans to seek Food and Drug Administration approval to use the drug as a preventive for a range of heart conditions, beyond its current role targeting high triglyceride levels.

In the interim, a battle is brewing among physicians, cardiovascular experts and pharma watchers who say Vascepa brings to the foreground troubling trends in the marketing and advertising of new drugs. Companies sometimes promote new products, but withhold the detailed findings until much later. The consequences for both consumers and the health system are vast.

“Until all the data is available for review by the public and medical community, it’s really premature to see some of the cheerleading that’s being done,” said Dr. Eric Strong, a hospitalist and clinical assistant professor at Stanford School of Medicine. “It’s harder to change people’s minds once you have these rosy pictures.”

John Thero, Amarin’s CEO, argued that the imminent release of the drug’s complete picture should alleviate those concerns.

In unveiling topline findings in a news release, he said, the company’s playbook doesn’t diverge from that of other pharmaceutical makers, and provides a necessary level of disclosure for shareholders.

But it’s the specifics in the data — for instance, which patients benefited, by how much, their absolute risk reduction and which precise conditions saw improvement — that illustrate whether a product is cost-effective, said medical and drug experts.

That’s especially true in the case of Vascepa, whose manufacturer is working hard to convince people the product is clinically superior to ordinary fish oil supplements. Fish oil, which can retail for a few dollars a bottle, has long been promoted as a preventive for heart disease. But the substance has never held up in clinical trials as a way to systematically lower disease risk, said experts.

That’s where Amarin’s product is superior, Thero said.

The manufacturer has tried to limit competition by seeking to block other fish oil products —arguing to the U.S. International Trade Commission that omega-3 supplements aren’t equivalents, and calling on the FDA to block a chemical component of fish oil, known as EPA and marketed by a number of supplement companies, from being sold as a dietary supplement. Amarin hasn’t yet prevailed.

Preston Mason, a biologist who consults for Amarin and has advocated on its behalf, argued that ordinary fish oil supplements carry risks because they are not regulated or approved by the FDA, which does oversee prescription drugs like Vascepa.

How Vascepa performs against regular fish oil remains unknown. Amarin’s trial compared the drug against a placebo, not over-the-counter supplements.

Vascepa itself isn’t new. It was approved in 2012 as a remedy for extremely high triglyceride levels, which can put patients at risk for pancreatic problems. But reducing that fat hadn’t been conclusively tied to, say, lowering the risk of heart attacks, or other major cardiac problems.

That link, ostensibly, is what Amarin is trying now to assert. And there’s plenty of money to be made if it succeeds.

As of last December, Vascepa retailed for about $280 for a month-long supply, a list price increase of 43 percent over five years, though the company says its net sale price has stayed the same. (That difference would come if Amarin increased the size of rebates, or discounts it provides, commensurate with price hikes.)

Now, citing the drug’s potentially increased value, Amarin has declined to say whether it will change the price again — though Thero said he sees greater profit potential if the company increases sales volume rather than price.

This gets at the crux of this debate. If a company makes available the technical details of a product, but only after hyping the findings, and if the details undercut some of that buzz — is it too late?

Dr. Khurram Nasir, a Yale cardiologist, acknowledged that it’s unclear how effective Vascepa really is, but maintained those ambiguities will be cleared up soon enough.

“As the findings reveal themselves, there will be a lot of discussion around cost effectiveness, and whether this is worth the spend,” Nasir said.

Mason, the Amarin scientist, said FDA scrutiny can also alleviate concerns about overhype.

But others worry the perception of Vascepa’s effectiveness is now set.

“People are weighing in with really strong language, without enough information,” said Dr. Lisa Schwartz, who co-directs the Dartmouth Institute’s Center for Medicine and Media and studies effective scientific communication.

That has both clinical and financial consequences, she added. Doctors are more likely to prescribe a product that’s been heavily promoted, even if subsequent discussion indicates the drug isn’t as powerful as initially implied. And manufacturers can cash in, whether through increased company stock market value or by charging higher list prices.

For Vascepa, the central question is which specific heart conditions saw risk reduction, she and others said. In its news release, Amarin noted a “composite outcome” — that is, the 25 percent relative improvement encompassed all conditions for which the researchers tested.

“People are saying, Wow, it reduced heart attack, stroke and blah, blah, blah — when it may just reduce the least important one,” said Dr. Steven Woloshin, Schwartz’s research partner.

Another issue: The Vascepa trial focused on a specific population — patients with high triglyceride levels plus elevated risk of cardiovascular disease or diabetes who were already taking a daily statin. That means any proof of benefit is limited to that group.

Woloshin and Schwartz both suggested that nuance could get lost in translation. “It is this much narrower, high-risk population,” Schwartz said.

Woloshin added, “The fear is [the message] would generalize to anyone with high triglycerides.”

This concern is amplified by a 2016 court settlement in which the FDA permitted Amarin to market Vascepa to audiences for whom it hasn’t been specifically approved — so long as the company doesn’t say anything untrue about the drug.

Thero said Amarin’s marketing of Vascepa has stayed, and will remain, consistent with what is factual and relevant.

“We are proceeding consistently with what the FDA has guided,” he said.

But, some experts said, the 2016 settlement could unlock the door to wider marketing of Vascepa’s off-label use, implying the pill benefits more people than it actually does.

“They’ll take pains to show how different this is from everything out there … and its results in these populations,” said Dr. Ameet Sarpatwari, an epidemiologist and lawyer at Harvard Medical School, who studies the pharmaceutical industry. “What they can’t do is say it will be beneficial to these other populations. But they can hint at that.”

This story was produced by Kaiser Health News, an editorially independent program of the Kaiser Family Foundation.