For a hospital that had once labored to break even, Wheeling Hospital displayed abnormally deep pockets when recruiting doctors.

To lure Dr. Adam Tune, an anesthesiologist from nearby Pittsburgh who specialized in pain management, the Catholic hospital built a clinic for him to run on its campus in Wheeling, W.Va. It paid Tune as much as $1.2 million a year — well above the salaries of 90% of pain management physicians across the nation, the federal government charged in a lawsuit filed this spring.

In addition, Wheeling paid an obstetrician-gynecologist a salary as high as $1.3 million a year, so much that her department bled money, according to a related lawsuit by a whistleblowing executive. The hospital paid a cardiothoracic surgeon $770,000 and let him take 12 weeks off each year even though his cardiac team also routinely ran in the red, that lawsuit said.

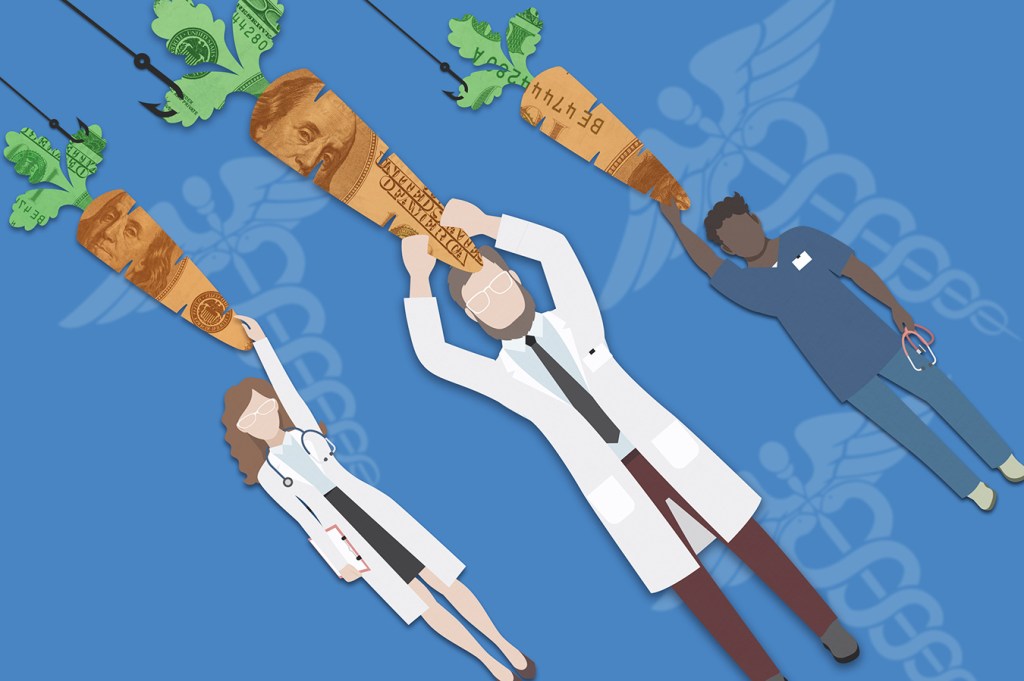

Despite the losses from these stratospheric salaries and perks, the recruitment efforts had a golden lining for Wheeling, the government asserts. Specialists in fields like labor and delivery, pain management and cardiology reliably referred patients for tests, procedures and other services Wheeling offered, earning the hospital millions of dollars, the lawsuit said.

The problem, according to the government, is that the efforts run counter to federal self-referral bans and anti-kickback laws that are designed to prevent financial considerations from warping physicians’ clinical decisions. The Stark law prohibits a physician from referring patients for services in which the doctor has a financial interest. The federal anti-kickback statute bars hospitals from paying doctors for referrals. Together, these rules are intended to remove financial incentives that can lead doctors to order up extraneous tests and treatments that increase costs to Medicare and other insurers and expose patients to unnecessary risks.

Wheeling Hospital is contesting the lawsuits. It said in a countersuit against the whistleblower that its generous salaries were not kickbacks but the only way it could provide specialized care to local residents who otherwise would have to travel to other cities for services such as labor and delivery that are best provided near home.

The hospital and its specialists declined requests for interviews. In a statement, Gregg Warren, a hospital spokesman, wrote, “We are confident that, if this case goes to a trial, there will be no evidence of wrongdoing — only proof that Wheeling Hospital offers the Northern Panhandle Community access to superior care, world class physicians and services.”

Elsewhere, whistleblowers and investigators have alleged that other hospitals, in their quests to fill beds and expand, disguise these arrangements by overpaying doctors or offering other financial incentives such as free office space. More brazenly, others set doctor salaries based on the business they generate, federal lawsuits have asserted.

“If we’re going to solve the health care pricing problem, these kinds of practices are going to have to go away,” said Dr. Vikas Saini, president of the Lown Institute, a Massachusetts nonprofit that advocates for affordable care.

‘It’s Almost A Game’

Hospitals live and die by physician referrals. Doctors generate business each time they order a hospital procedure or test, decide that a patient needs to be admitted overnight or send patients to see a specialist at the hospital. An internal medicine doctor generates $2.7 million in average revenues — 10 times his salary — for the hospital with which he is affiliated, while an average cardiovascular surgeon generates $3.7 million in hospital revenues, nearly nine times her salary, according to a survey released this year by Merritt Hawkins, a physician recruiting firm.

Last August, William Beaumont Hospital, part of Michigan’s largest health system and located outside Detroit, paid $85 million to settle government allegations that it gave physicians free or discounted offices and subsidized the cost of assistants in exchange for patient referrals.

A month later in Montana, Kalispell Regional Healthcare System paid $24 million to resolve a lawsuit alleging that it overcompensated 63 specialists in exchange for referrals, paying some as full-time employees when they worked far less. Both nonprofit hospital systems did not admit wrongdoing in their settlements but signed corporate integrity agreements with the federal government requiring strict oversight.

“It’s almost a game of ‘We’re going to stretch the limits and see if we get caught, and if we get caught we won’t be prosecuted and we’ll pay a settlement,’” said Tom Ealey, a professor of business administration at Alma College in Michigan who studies health care fraud.

Dubious payment arrangements are a byproduct of a major shift in the hospital industry. Hospitals have gone on buying sprees of physician practices and added doctors directly to their payrolls. As of January 2018, hospitals employed 44% of physicians and owned 31% of practices, according to a report the consulting group Avalere prepared for the Physician Advocacy Institute, a group led by state medical association executives. Many of those acquisitions occurred this decade: In July 2012, hospitals employed 26% of doctors and owned 14% of physician practices.

“If you acquire some key physician practices, it really shifts their referrals to the mother ship,” said Martin Gaynor, a health policy professor at Carnegie Mellon University in Pittsburgh. Nonprofit hospitals are just as assertive as profit-oriented companies in seeking to expand their reach. “Any firm — it doesn’t matter what the firm is — once they get dominant market power, they don’t want to give it up,” he said.

But these hires and acquisitions have increased opportunities for hospitals to collide with federal laws mandating that hospitals pay doctors fair market value for their services without regard to how much additional business they bring through referrals.

“The law is very broad, and the exceptions are very narrow,” said Kate Stern, an Atlanta lawyer who represents hospitals.

‘A Man We Need to Keep Happy’

Lavish salaries for physicians with high potentials for referrals was the key to the business plan to turn Wheeling Hospital, a 247-bed facility near the Ohio River, into a profit machine, according to a lawsuit brought by Louis Longo, a former executive vice president at the hospital, and a companion suit from the U.S. Department of Justice.

Between 1998 and 2005, Wheeling Hospital lost $55 million, prompting the local Catholic diocese to hire a private management company from Pittsburgh, according to the suits. In 2007, the company’s managing director, Ronald Violi, a former children’s hospital executive, took over as Wheeling’s chief executive officer.

The hospital remained church-owned, but Violi adopted an aggressively market-oriented approach. He began hiring physicians — both as employees and independent contractors — “to capture for the hospital those physicians’ referrals and the resulting revenues, thereby increasing Wheeling Hospital’s market share,” the government alleged. Along with greater market share came the ability to bargain for higher payments from insurers, according to Longo’s suit.

The government complaint said at least 36 physicians had employment contracts tied to the business they brought to the hospital. Hospital executives closely tracked how much each doctor earned for the hospital, and executives catered to those whose referrals were most lucrative.

In 2008, the hospital’s chief financial officer wrote in an internal memorandum that cardiovascular surgeon Dr. Ahmad Rahbar “is a man we need to keep happy” because the previous year “he generated over $11 million in revenues for us,” according to the government’s lawsuit.

Dr. Chandra Swamy, an obstetrician-gynecologist the hospital hired in 2009, was another physician whose referrals Wheeling coveted. By 2012, Wheeling was paying her $1.2 million, four times the national median for her peers, according to Longo’s suit.

An internal memorandum by the hospitals’ chief operating officer quoted in Longo’s lawsuit said that the labor and delivery practice where Swamy worked was the biggest money loser among the specialty divisions and that her salary made it “almost impossible for this practice to show a bottom line profit.” But the memo went on to conclude that Wheeling should “continue to absorb the practice loss” because it “would not want to endanger the significant downstream revenue that she produces” for the hospital: nearly $4.6 million a year, according to the lawsuit.

In some cases it was the specialists who demanded lopsided pay packages. When Wheeling, eager to get a piece of the booming field of pain management, decided to recruit Tune, the anesthesiologist responded that he wanted an “alternative/undefined model” of compensation that could earn him $1 million a year, according to Longo’s lawsuit.

Instead of making Tune an employee, Longo alleges, Wheeling leased clinic space to a company created by Tune and paid him $3,000 a day — more than $700,000 a year. In its initial contract, Wheeling also let Tune keep 70% of his practice’s net income, according to the government’s complaint.

Two years later, when the hospital’s chief lawyer raised legal concerns, Wheeling revised the contract, dropping the profit-sharing provision but boosting Tune’s daily stipend to $6,100. The government complaint said this was designed to make up for the lost incentives and thus remained illegally based on how much business Tune generated for Wheeling. Indeed, Tune and his clinic earned roughly the same amount of money as they had received before the new compensation package, the complaint indicated.

Longo said his resistance to such deals rankled both Violi and physicians. He was fired in 2015 because, he alleged, of his objections to various contracts the hospital struck with physicians. The hospital countersued in March, saying Longo had breached his fiduciary duties because he never reported any financial irregularities when he worked there. Wheeling said that after Longo was fired, he threatened to file his lawsuit unless he received a settlement. Longo has asked that the case be dismissed and said in court papers he told Violi about his concerns on “multiple occasions.”

As a whistleblower, Longo is entitled to receive a portion of any money the government collects in its complaint. Longo’s lawyer said he would not comment for this story.

In financial terms, Wheeling’s tactics succeeded. According to the government’s suit, over the first five years under Violi, Wheeling earned profits of nearly $90 million. Violi’s management firm, R&V Associates, also prospered: Wheeling more than doubled the firm’s annual compensation from $1.5 million in 2007 to $3.5 million in 2018. Violi and his lawyer did not respond to requests for comment.

“The hospital has benefited tremendously from Ron’s keen business acumen,” Monsignor Kevin Quirk, the hospital board chairman, said last week in announcing Violi’s retirement.

Wheeling’s quality of care has not excelled commensurately, however, according to Hospital Compare, Medicare’s consumer website. Patients with heart failure or pneumonia are more likely to die than at most hospitals. In April, Medicare awarded Wheeling Hospital its lowest rating, one star, for overall quality.

This story was produced by Kaiser Health News, an editorially independent program of the Kaiser Family Foundation.